vehicle sales tax in memphis tn

Single Article Tax Total Sales Tax Note. Motor Vehicles Title Applications.

Tennessee Vehicle Sales Tax Fees Calculator Find The Best Car Price

Other taxes collected by the City of Memphis include Payment in Lieu of Taxes PILOT and Central Business Improvement District CBID taxes for taxable entities in the Downtown.

. Tennessee has a 7 statewide sales tax rate but. Tennessee collects a 7 state sales tax rate. Motor vehicle or boat is subject to the sales or use tax.

The current total local sales tax rate in Memphis TN is 9750. 3 beds 2 baths 1400 sq. Memphis TN Sales Tax Rate.

TN Sales Tax. Name A - Z Sponsored Links. Local Sales Tax.

Vehicle Tax in Memphis TN. Vehicle Sales Tax Calculator. Fuller T O State Park.

State Parks State Government County. 4789 Northdale Dr Memphis TN 38128 199000 MLS 10133233 Beautifully UPDATED home with large fenced yard and two car. Purchasers of new and used vehicles must pay state sales tax at the rate of 7 percent and the state single-article tax at the rate of.

If a lien is being recorded to a vehicle at the time of purchase add 1100 notation of lien fee to all fees listed. This is the total of state county and city sales tax rates. VTR-34 - Sales Tax on a Vehicle Purchase.

The 975 sales tax rate in Memphis consists of 7 Tennessee state sales tax 225 Shelby County sales tax and 05 Memphis. The sales tax is comprised of two parts a state portion and a local. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

What is the sales tax rate in Memphis Tennessee. Obtaining a Title Transfer or New Vehicle Title Tennessee State law requires that any vehicle operated on the roads of Tennessee be properly titled registered and that appropriate sales. Abandoned Immobile or Unattended Vehicles.

The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections. Titling a Vehicle New Residents of Those Relocating to Tennessee What to Do If You Do Not Have a Title. The December 2020 total local sales tax rate was also 9750.

Department of Revenue David Gerregano Commissioner 500 Deaderick Street Nashville TN 37242 Department Contact. For vehicles that are being rented or leased see see taxation of leases and rentals. The Chancery Court Clerk Masters Office is responsible for conducting public auctions for delinquent real estate property taxes in Shelby County for both City of.

Vehicle Sales Tax Calculator. The minimum combined 2022 sales tax rate for Memphis Tennessee is. WarranteeService Contract Purchase Price.

Tennessee sales and use tax rule 1320-05-01-03 Charges made by a dealer to customers for title fees are considered pass through. Memphis collects the maximum legal local sales tax. There is a maximum tax charge of 36 dollars for county.

Find information motor vehicle registration in Tennessee.

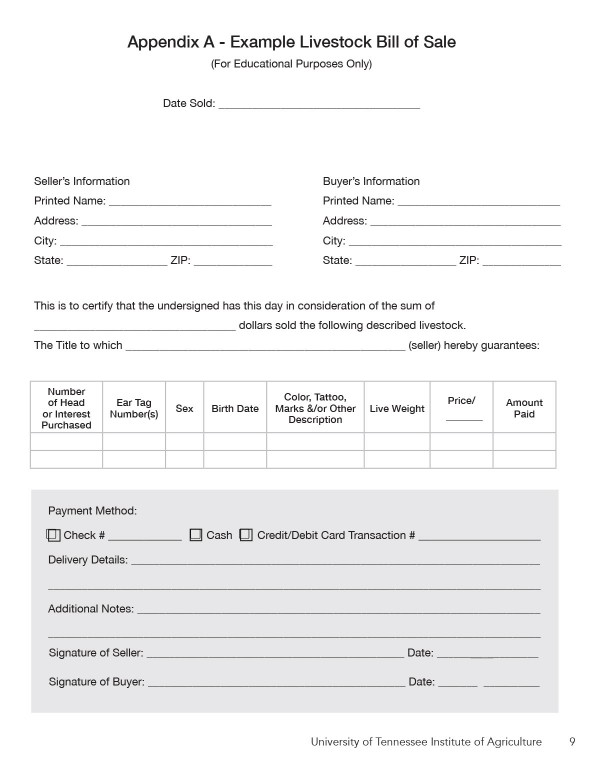

Bills Of Sale In Tennessee The Forms Facts Requirements

Memphis Tennessee 1926 Postcard Cositt Library Custom House Ebay

Used Land Rover For Sale In Memphis Tn Cargurus

:quality(70)/d1hfln2sfez66z.cloudfront.net/07-29-2022/t_7a07031e94834386935555f70f27bc12_name_file_960x540_1200_v3_1_.jpg)

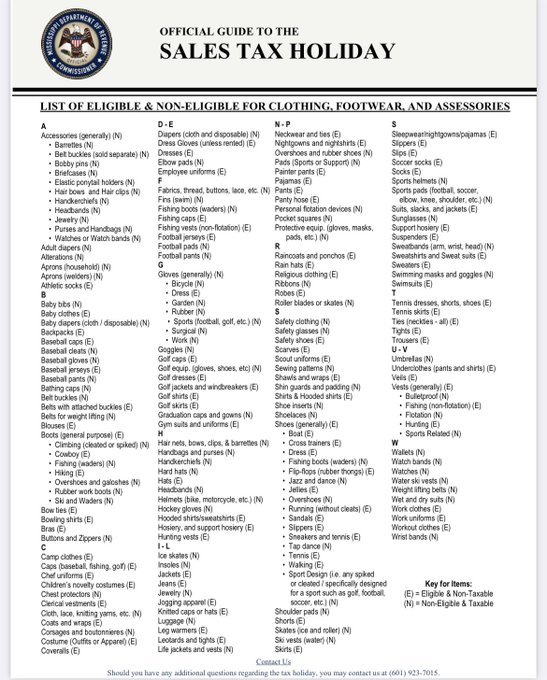

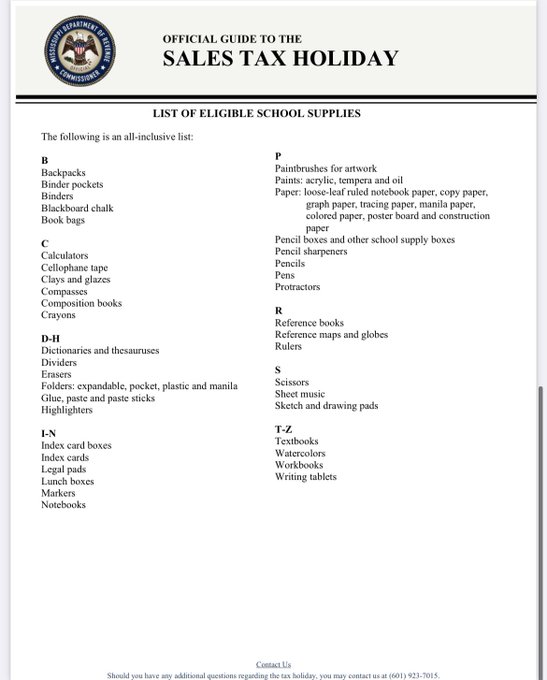

Sales Tax Holidays Begin In Tennessee Mississippi Fox13 News Memphis

Cheap Cars For Sale In Memphis Tn Carsforsale Com

Tennessee Budget Primer The Sycamore Institute

Used Cars Under 5 000 For Sale In Memphis Tn Vehicle Pricing Info Edmunds

Sales Tax Holidays Begin In Tennessee Mississippi Fox13 News Memphis

Used Ford Escape Hybrid For Sale In Memphis Tn Cargurus

Tennessee Waives Vehicle Registration Fees For A Year

New Honda Inventory Memphis Tn Autonation Honda Covington Pike

Sales Tax Holidays Begin In Tennessee Mississippi Fox13 News Memphis

What S The Car Sales Tax In Each State Find The Best Car Price

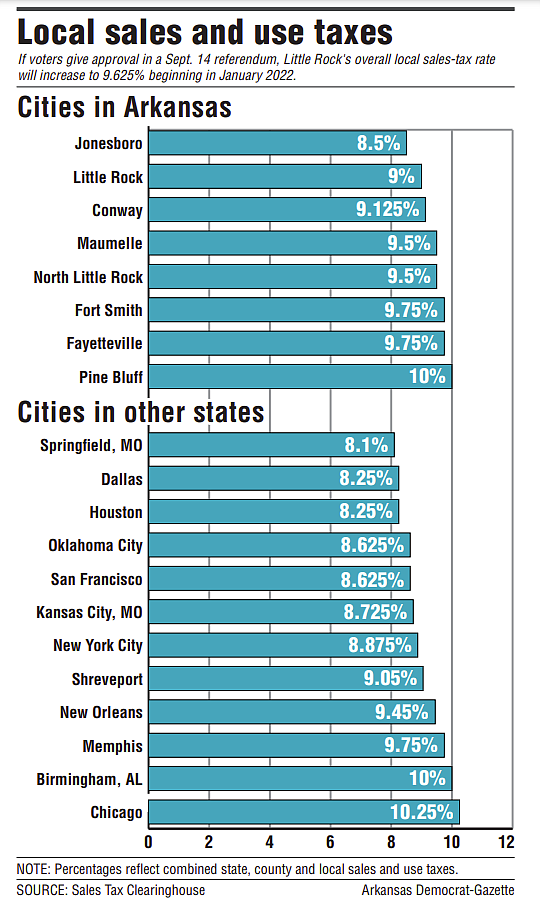

As Tax Rates Go Arkansas At Top

Cars Sale Lease Inc Cars For Sale Memphis Tn Cargurus